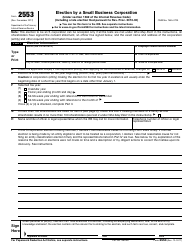

If you discovered that someone may have filed your taxes because your online tax return was rejected, you should file Form 14039. If you received a letter from the IRS informing you that your Social Security number may have been used to file in your name, immediately call them using the number provided on the letter. The sooner you respond, the quicker you can remedy the situation. It’s very important that you respond quickly to ensure the safety and integrity of your tax information.

There are several things you should do once you are sure or even suspect that someone else has filed taxes in your name. What to Do if Someone Else Filed Your Taxes

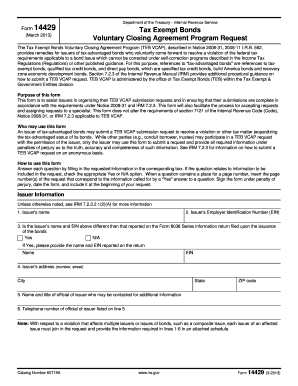

You’ll need to bring your government-issued ID and Social Security card with you. Contact your local IRS office to make an appointment. Those who earn above $72,000 per year can request an appointment to verify their identity in person. Please note that this form can only be used for those whose gross annual income is below $72,000. You can request an IP-PIN when logging in to your IRS.gov account, or you can request one using Form 15227. An IP-PIN is a six-digit PIN that adds an additional level of security to your personal information when logging in to your IRS.gov account. If you file your taxes with the IRS using their online method, you can request an IP-PIN to gain access to your online account. Use an Identity Protection PIN When Filing Your Taxes Online This information is usually a passcode or PIN that you’ve set up and will receive via text, something an identity thief wouldn’t have access to. By enabling multi-factor authentication, you’ll be asked for additional information before accessing your account. This is an excellent way to protect your personal information from online thieves.

#Irs fax number fill tax return software

If you use online tax preparation software to file your taxes, always use multi-factor authentication. The IRS will never call you without prior notification. They do this primarily if you owe them a significant amount of money. Please note that the IRS will never call you directly without first officially informing you by mail that they may attempt to contact you on the phone. This is a common technique that scammers will use to get your personal information. Never give your personal information to anyone who calls or emails claiming to be a representative of the IRS. Protect Your Personal Information Online and on the Phone Any document that contains your personal information should also be shredded when it’s time to discard them. When it comes time to discard your older tax returns, it’s best to shred them. Tax refund thieves need your Social Security number to file taxes in your name, so safeguarding this information is of utmost importance. Keep your Social Security card and tax returns in a secure location.

Listed below are some of the things you can do to protect yourself. Identity theft has become all too common in today’s world, but there are ways to prevent it from happening to you by following a few safety guidelines. There are several things you can do to protect yourself against someone else filing your taxes.

#Irs fax number fill tax return how to

How to Protect Yourself Against Tax-Related Identity Theft

0 kommentar(er)

0 kommentar(er)